HR - Federal W-4 Form

The Federal W-4 form is an essential part of any Human Resources compliance strategy. It begins by ensuring proper documentation for your new hires tax withholding is completed, collected, executed and filed so that managers can provide on demand access in the event of an audit.

Through the use of the GlobalForms 10 option with Business Essentials, you can easily add a workflow that drives this process through a completely digital series of actions. The 2020 Federal W-4 form that most employers will immediately recognize has been digitally transformed so it can be easily loaded into your GlobalForms instance. The accompanying workflow enforces the process of information collection, completion of the optional worksheets and filing the form into your Business Essentials repository.

Download

To see a demonstration of Federal W-4 form, you can find it in the GlobalForms Forms Gallery located here.

To download a copy of the form for import into your own instance of GlobalForms click here.

Form Use

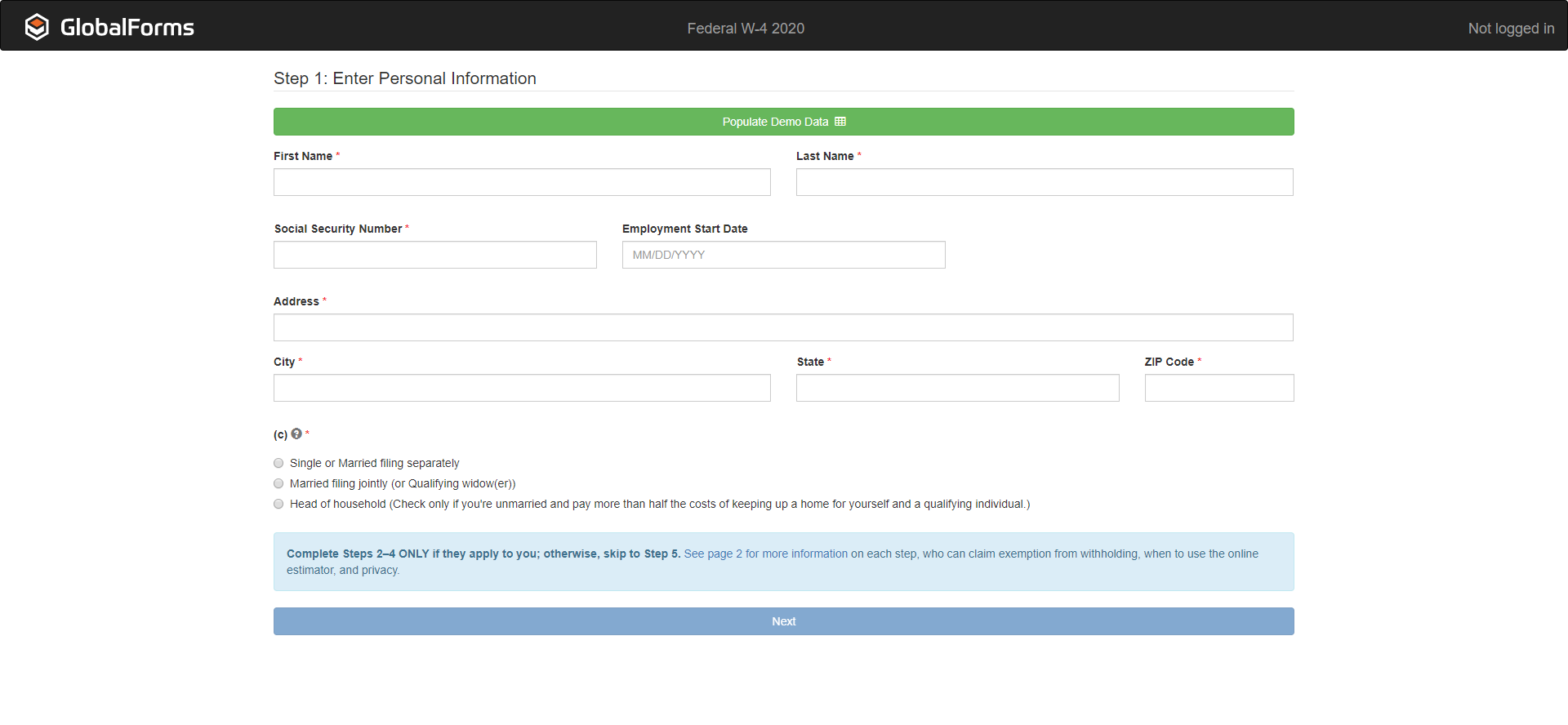

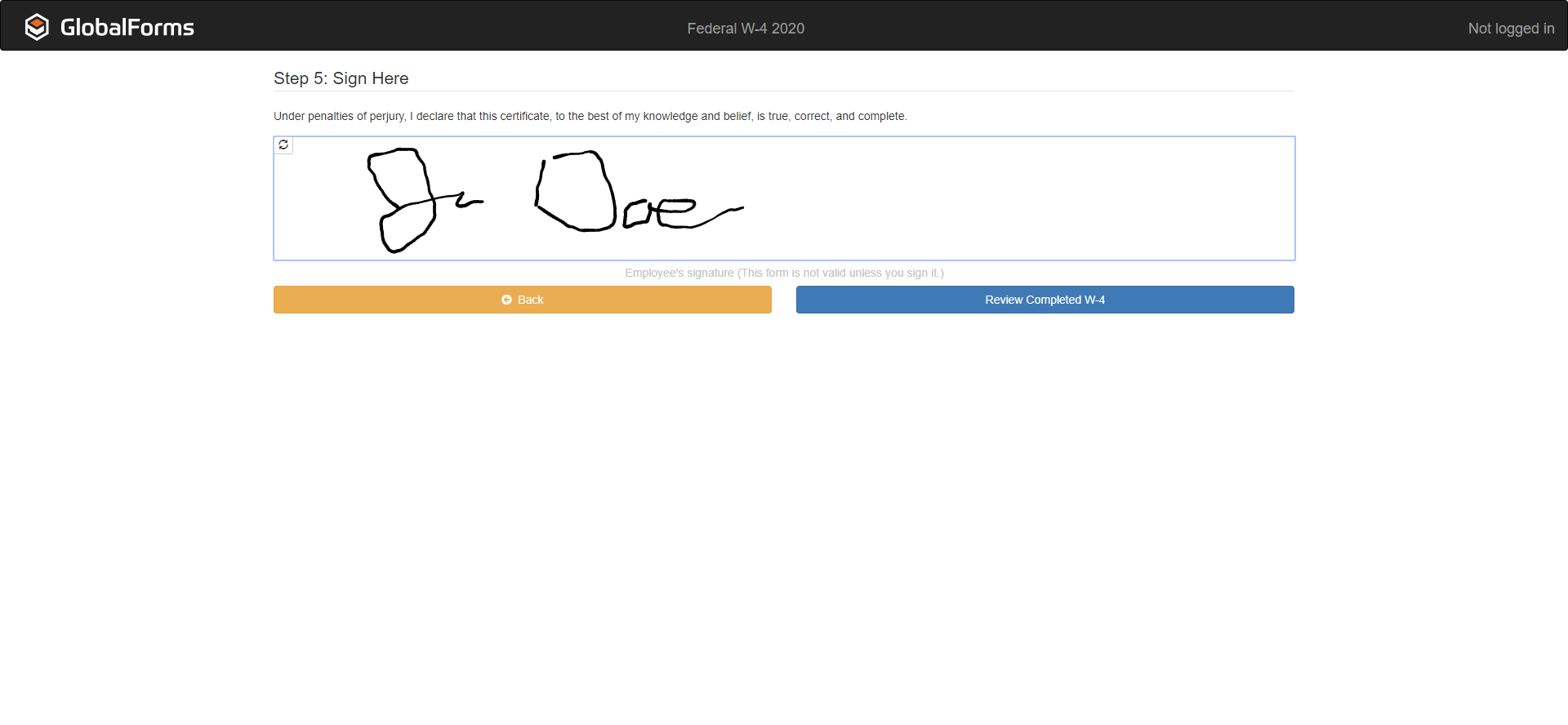

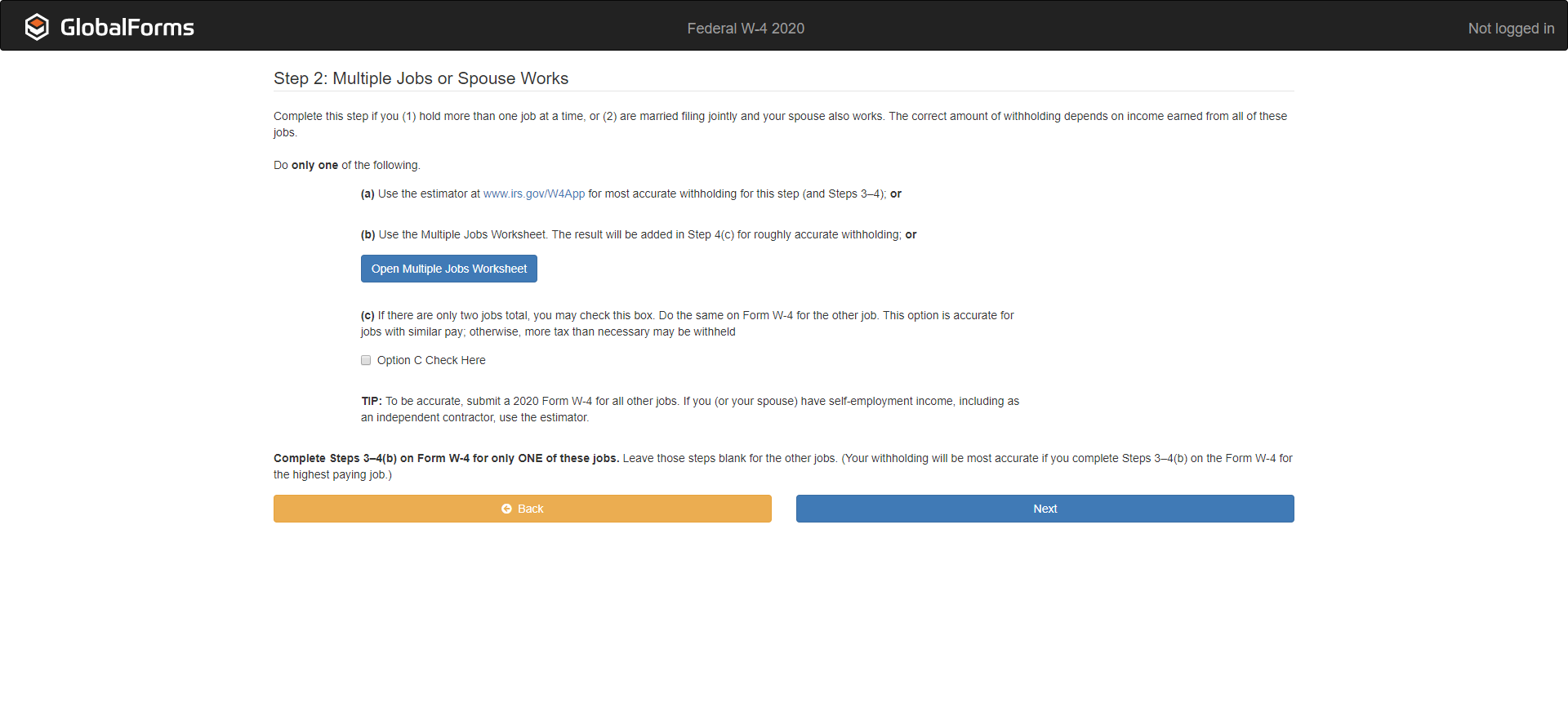

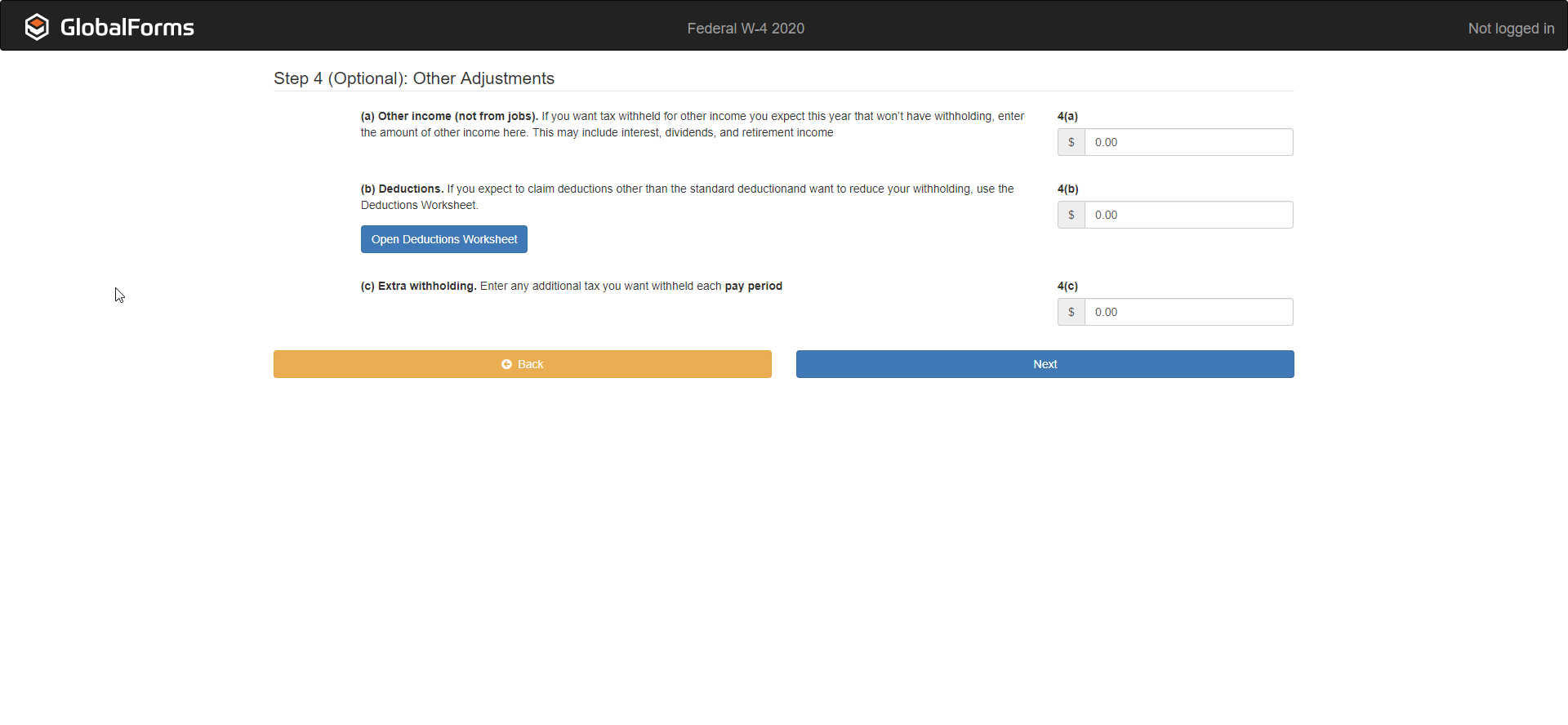

The process logic for completing the W-4 form and providing the supporting documentation is built directly into the GlobalForms web form. The form appears as a multi step workflow that the employee can quickly complete in the same manner as they would a paper based copy. It also includes an e-Sign compliant digital signature field so that the employee can legally attest to the accuracy of the information they are providing.

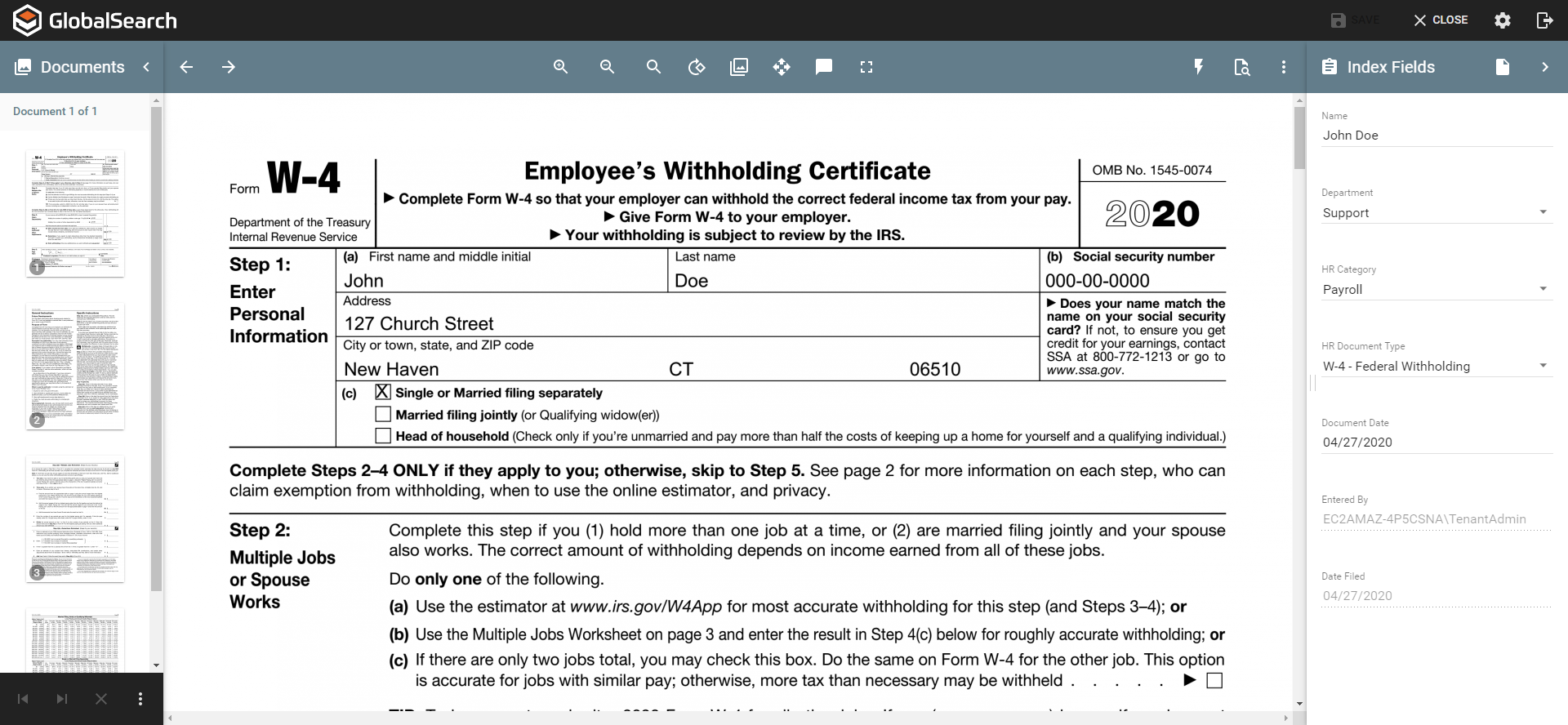

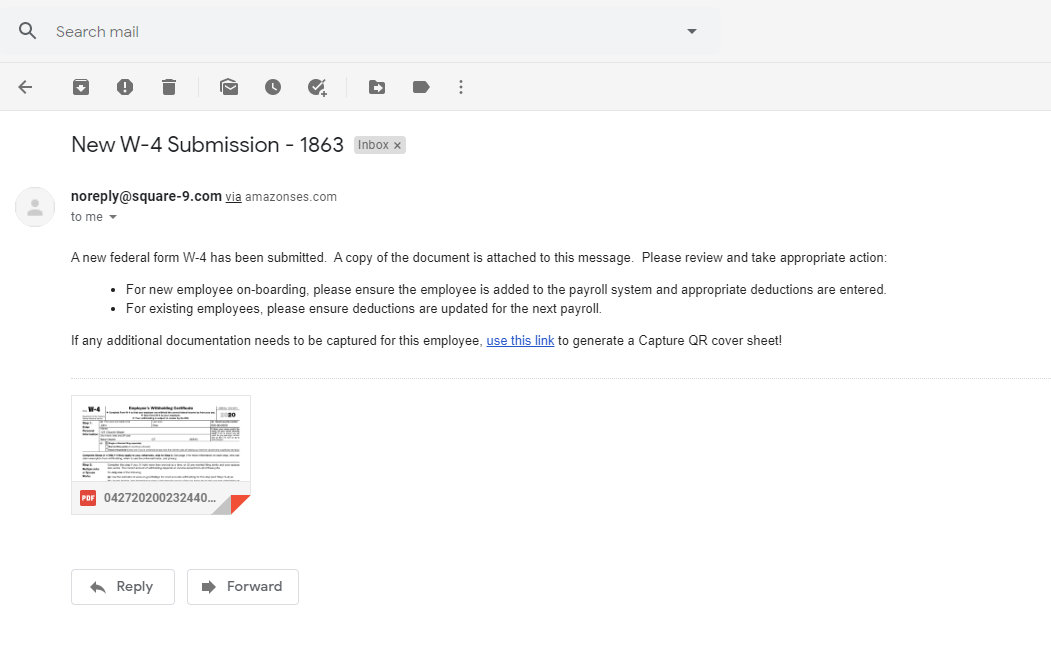

Upon submission, a copy of the completed form is delivered to the employee via email and the fully indexed record is filed in GlobalSearch, SharePoint, OneDrive or the ECM system of your choice.

Step 1 - Enter the Required Information

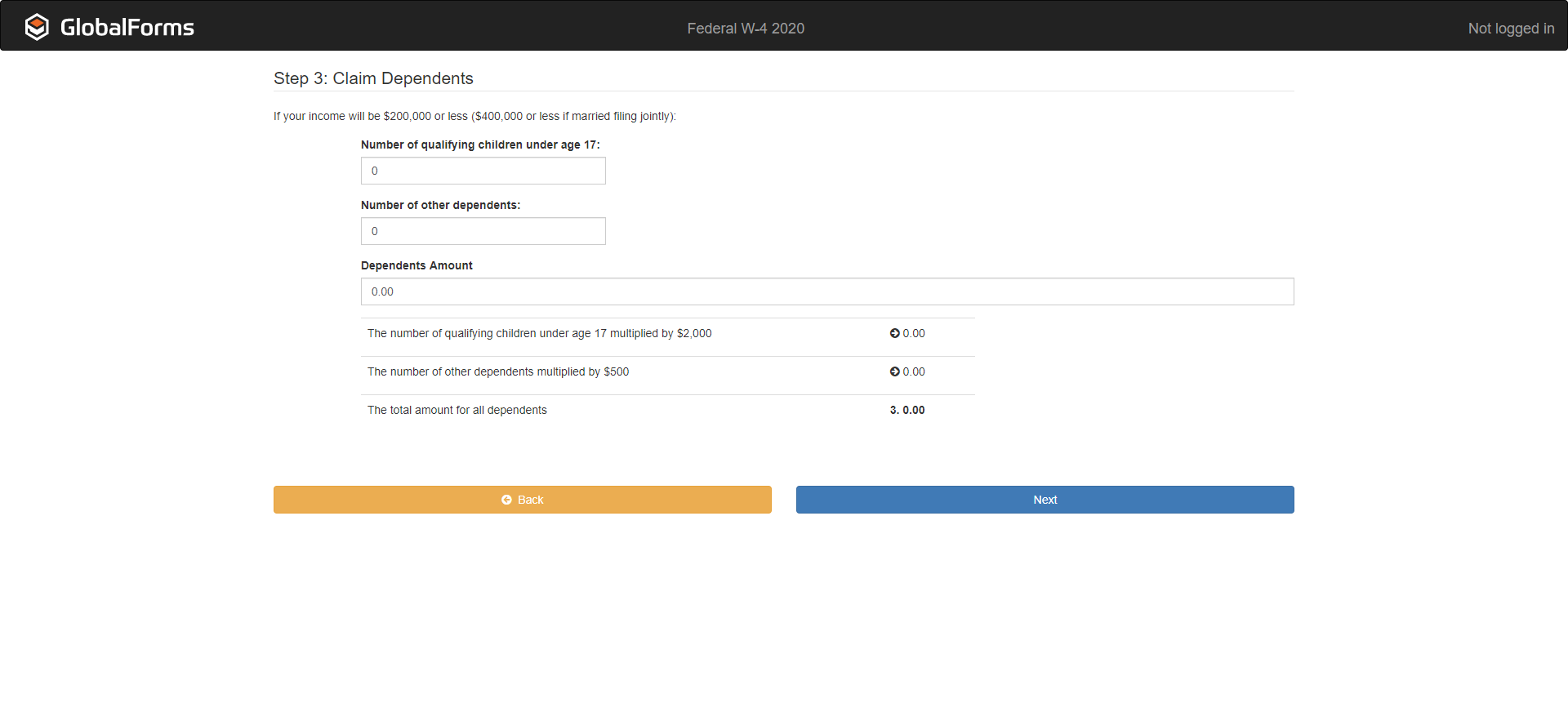

Step 3 - Claim any dependents and calculate your deduction

Step 5 - Execute using an eSign compliant electronic signature

Upon submission, a copy of the completed form is sent to the new hire and a copy of the document is sent directly to GlobalSearch for permanent retention.

Step 2 - Complete the worksheet required for multiple jobs or working spouse

Step 4 - Complete the optional worksheet for any non income related adjustments

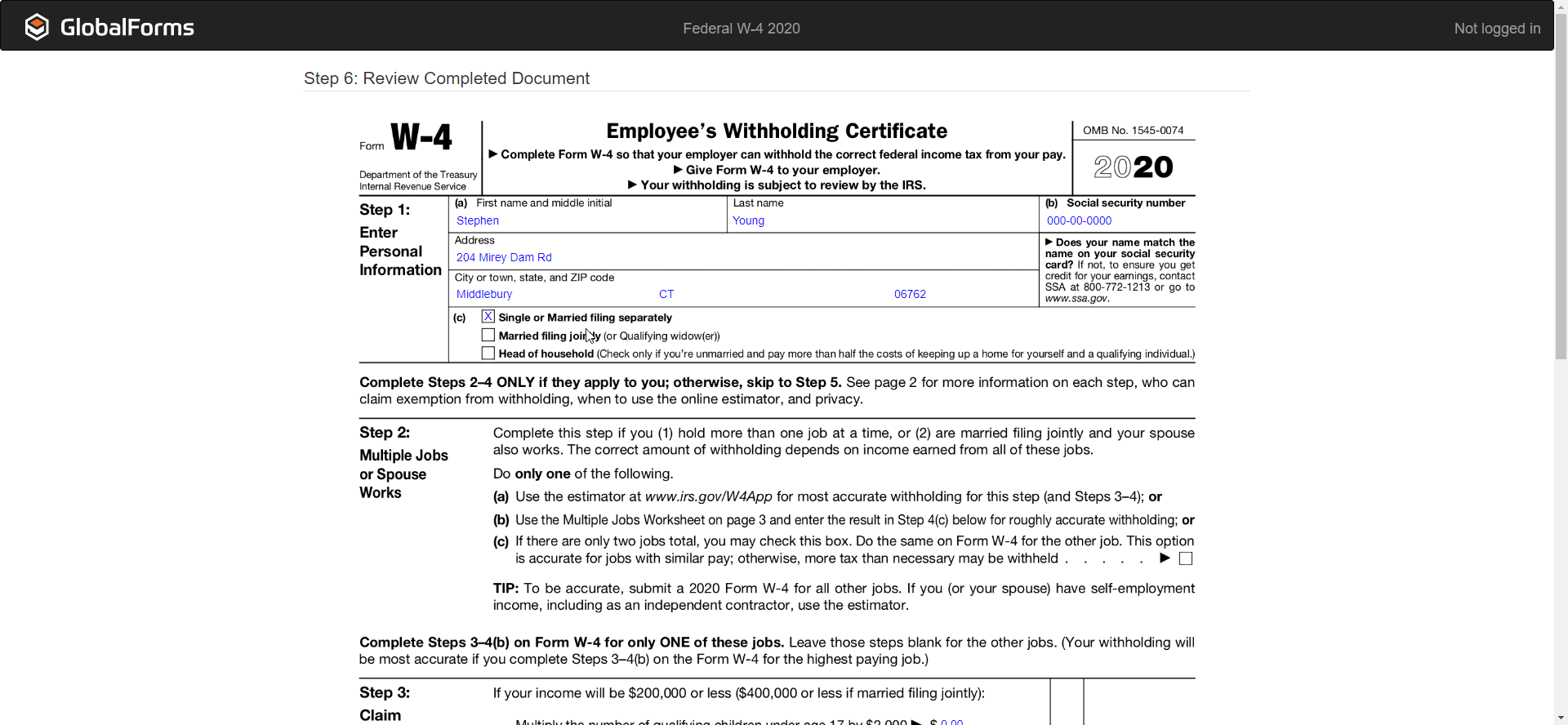

Step 6 - Review and Submit the completed Federal W-4 form